Today I’m going to throw out a few miscellaneous small tips that may help you when you are working with QuickBooks. No particular theme, just a random collection.

If any of you have some helpful tips to add, pass them on in a comment here! I’ll add them to the article.

This has been a crazy couple of weeks. Power failures (thank goodness for battery backups!), failing web hosts (I had to switch my blogs to a new host, which was complicated), crashing hard drives (thank goodness for good backup procedures, and Carbonite!), all decided to bedevil me at the same time. Maybe that is what I should be blogging about! However, rather than gripe about my problems, let’s talk about QuickBooks.

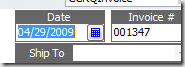

Dates

When I’m entering transactions, I’m often entering several days of transactions at a time. I’ll enter several invoices, and for each one I have to enter the date. QuickBooks is usually set up to remember the last date you used in a transaction, so as I enter each invoice for the week the default date is the last date used.

Tip: If you type the letter “T” in a date field, it will enter Today’s date.

This can be handy when you are using the Find function to search for transactions – enter “T” for Today to find today’s transactions.

Note that there are other shortcuts for dates, and other functions. See my article on QuickBooks Shortcuts.

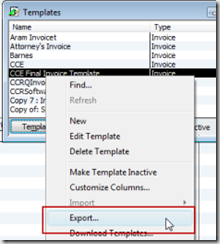

Form Templates

Many people spend a lot of time modifying their form templates (invoices, purchase orders, etc.). QuickBooks, however, can’t be trusted to keep your modified templates safe. The templates are stored in the database (QBW) file, and sometimes a template can become corrupted and unusable. You can restore a backup copy of your QBW file, but you will lose any transactions you entered since that backup was made (you do have a current backup, right?).

etc.). QuickBooks, however, can’t be trusted to keep your modified templates safe. The templates are stored in the database (QBW) file, and sometimes a template can become corrupted and unusable. You can restore a backup copy of your QBW file, but you will lose any transactions you entered since that backup was made (you do have a current backup, right?).

Tip: Export your templates and save them on a CD for safekeeping.

Select Lists and then Templates, and click on your modified template to select it. Right click on it and select Export, and you will be asked for a location to safe the template file. This will be a “DES” file. Save them in a safe place, and make new backup copies when you modify your templates.

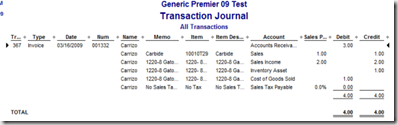

Debits and Credits

QuickBooks is a “double entry” bookkeeping system – every transaction has two sides. Sometimes it might not be clear just what accounts are being posted to in a particular transaction, such as an invoice.

Tip: Press ctrl-Y when looking at a transaction to see the transaction journal for that transaction.

A transaction journal listing for a specific transaction will show you every account that is debited and credited. It is a quick and easy way to see what is going on “under the hood”. Here is a highly compressed example from an invoice:

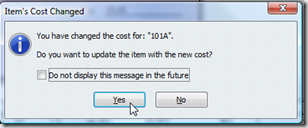

Why Doesn’t QuickBooks Ask Me…

QuickBooks always throws a lot of questions at you – do you want to do this or that, do you know that this is  available, things like that. Some of these questions you never want to see again, but some of them may be important. One example – when you receive an inventory item and the received cost is not the same as the cost value in the item record, QuickBooks may ask you if you want to update the cost of the item. Sometimes you want to update, other times you might not want to. This may be an important feature for your business.

available, things like that. Some of these questions you never want to see again, but some of them may be important. One example – when you receive an inventory item and the received cost is not the same as the cost value in the item record, QuickBooks may ask you if you want to update the cost of the item. Sometimes you want to update, other times you might not want to. This may be an important feature for your business.

Then, one day, you notice that QuickBooks isn’t asking you this question any more! This complaint is a common one in the Intuit Community forums. What probably happened was that you clicked the do not display this message in the future box, so QuickBooks won’t ask you again.

Worse than that, QuickBooks remembers the way you answered that question when you clicked the box, and it might not have been the right answer!

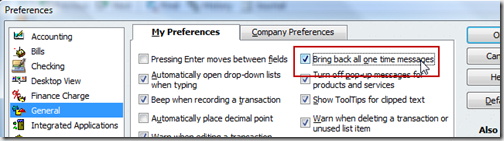

Tip: Check the “bring back all one time messages” box to bring back those messages.

You will find this in the Preferences function of the Edit menu. Check the box, click “OK”, and the messages will come back. All of them. Even the ones you don’t want.

You will find this in the Preferences function of the Edit menu. Check the box, click “OK”, and the messages will come back. All of them. Even the ones you don’t want.

That’s all for today – let me know if you like this kind of article, and pass on your tips that you would like to share!

thanks so much for these tips! i think they are great information and will help me out a lot. especially the “T” for today and the “cnrtl Y” for the transaction journal. keep ’em coming!

This was great!!!! Yes, I knew most of them, but there is always one or two that you either didn’t know or forgot. Please do this again!

Keep those tips and tricks coming! As I learn new ones I like to pass them on to my clients. It helps them and makes me look more like an expert. Thanks.

Charlie –

If you have a report that is under Memorized Reports that you created – how can you delete them from the list?

Thanks Ditto

To delete memorized transactions: Press ctrl-T to show the list of transactions, click on the transaction to delete from the list, ctrl-D to delete it (or select the “edit” menu at the top of the screen and select the delete option).

To delete memorized reports: Select “reports”, “Memorized Reports”, then “Memorized Report List” to see the list. Click on the report to select it, ctrl-D to delete it (or select the “edit” menu and select the delete option)

You have saved me so much time and frustration. I have pulled most of my hair out over the issue of digging deeper to find out which accounts have been used on a transaction (debits and credits). I think you are going to help me keep what little hair I have left! Many thanks.

There are other shortcuts that can be used in the date field. “Y” takes you to the first day of the year, and “R” takes you to the last. Since these are the first and last letters of the words themselves, I find them very easy to remember (unlike the sometimes tortured “mnemonics” found in other programs). The same idea applies if you use the words MontH and WeeK.

You are right, there are a lot of keyboard shortcuts. I have an article that lists many more, at https://qbblog.ccrsoftware.info/2009/07/quickbooks-keyboard-shortcuts/

Yes, these were great. Anymore coming soon?

Glad you like it, Pat. I’m accumulating things as I go along, and when I get a slow week, I’ll write another article. Subscribe, and you’ll see!

Addendum to dates tip: You can also use the “+” and “-” keys to go back or forward one day at a time from the date in the current field. You can also use “Y” for beginning of current Year or “R” for end of current yeaR; “M” or “H” for begin/end of current MontH.

Addendum to Transaction Journal: As I remember, in the Accountant’s Editions, the Debit and Credit field is displayed by default. In the other editions, this report only shows the net Balance so you may have to modify the report to see the Debit and Credit amounts.

He, Ed. I wrote another article on shortcuts at https://qbblog.ccrsoftware.info/2009/07/quickbooks-keyboard-shortcuts/ and this one mentions the other options for dates. I’ll modify this posting to point to that article.

Thanks for the note on the transaction journal.

I apologize if I’m posting this in the wrong forum, however I didn’t see a related topic. Your website has been a great resource for a new Quickbooks user, however I have to get over a very important hurdle and that is – will Quickbooks work for my business? We run a residential gutter cleaning business and need to track each time we do a cleaning for a customer (date, price, etc.). We have approx 1500 customers and each customer can have 1-4 cleanings per year. Should I use the job feature? Or use dummy invoices. We are using Quickbooks to create estimates, manage customer data and (hopefully) manage cleaning history. All invoicing and billing is done outside of Quickbooks by a separate party. We are currently using Quickbooks Pro 2007, but plan on upgrading to 2010 very soon. We also have the latest version of MS Outlook and MS Office which we may have to use if Quickbooks does not meet our needs. I also have a question about creating a mail merge form letter from a QB customer list report.

Noreen, this really isn’t a great place to ask general questions. We aren’t really set up for that. You are better off going to the Intuit Community Forum at http://community.intuit.com/quickbooks and asking your questions there. You will find many people who can help, and the format is set up better for an interactive dialog between people. You can use QuickBooks for your kind of business – I don’t know that I’d worry about using “jobs” or not unless you have multiple residences for one customer. I’m not sure what you mean by “dummy invoices”.

Charlie,

I was hoping I would find an article on creating and modifying QuickBooks custom summary and detail transaction reports among your blogs. The information in Help is very spread out under many topics. Currently I am trying to figure out how to add a subtotal to an existing report that I modified. Help claims you can do it but does not tell you how. Maybe the information is there but I could not find it.

Examples of transactions reports I would like to create are:

(1) payment history for a particular customer

(2) sales history for a particular customer

(3) sales history for a particular inventory item

Maybe this is too big a topic to cover, but I would appreciate your thoughts or direction.