I use QuickBooks to manage my small business, and it is tax time. There are a few reports that can help preparing information for my tax return that I’d like to point out. I was surprised to find in a survey of my clients that many didn’t know about these features.

Please note that I am not a CPA or bookkeeper. I’ve got a good background in accounting, and I’ve been doing the taxes for my small business for many years, but I’m not qualified to give specific tax or accounting advice. What I’m giving here is my opinion, and pointing out some features in QuickBooks that many people overlook.

Chart of Accounts

I organize my chart of accounts and Profit & Loss statement to help manage my business. I have a variety of subaccounts that help give me a picture of how different aspects of my business are working. However, when it comes to filing tax papers, I need to provide the information in a different format. In my income tax return (I use a Schedule C) there will be an entry for advertising, for example, but in my chart of accounts (COA) I could have totally separate entries, not necessarily adjacent in the COA, for advertising expenses related to local business (newspaper, phone book) and expenses related to web advertising (blog expenses, Google Adwords and so forth). I used to use Excel and/or a calculator to gather together these different values into one amount for the tax return, which was inconvenient and had the potential for error.

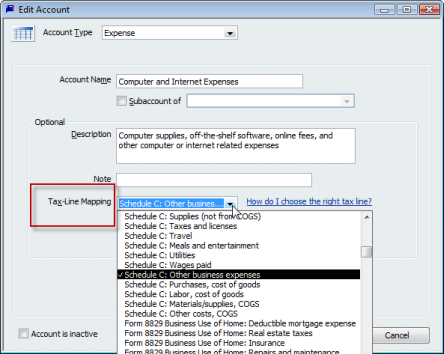

To help with this, when you add or edit an account in the COA you can select a “tax line mapping”. I used to ignore this, figuring that it was for those who used an accountant to transfer the information to tax preparation software.

Select the appropriate place in your tax form for each of the accounts you have. You can pick <not tax related> as an option for accounts you won’t be using in tax returns, such as owner’s capital. Do not leave them <unassigned>.

Income Tax Preparation Report

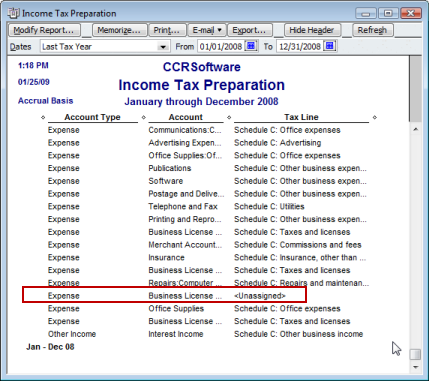

Now let’s look at how these assignments help us with the tax return. Go to the Reports menu and select the Accountant & Taxes section. Locate the Income Tax Preparation report. This will show all of your accounts and the tax line mapping assignments.

Review this to look for any accounts that are “Unassigned”, and go back to your chart of accounts to correct this.

Income Tax Summary

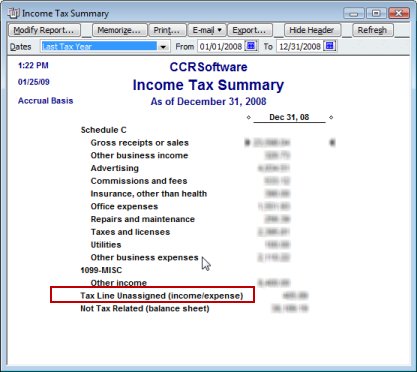

Once you have your Chart of Accounts mapped you can run the Income Tax Summary report, which will take your financial information and summarize it by the tax lines you mapped.

Note that this report will also show you if yu have some unassigned lines. THIS information is what you need for your income tax papers – with the amounts totalled for you. It simplifies the task, and does the math correctly. You can, if you wish, export this report to Excel.

Using TurboTax with QuickBooks

If you happen to use TurboTax (which I do) then you can directly import this information into TurboTax from within the TurboTax program itself.

[…] QuickBooks Tax Accounting for a Small Business […]

Note that this report will also show you if you have some unassigned lines. THIS information is what you need for your income tax papers – with the amounts totaled for you. It simplifies the task, and does the math correctly. You can, if you wish, export this report to Excel.

Mr. Russell:

This is our first year our accountant is doing taxes for our new company. She is not familiar with QB so we are running into a big problem. She is asking me about a missing journal entry although I rarely use the general journal. We bring in lumber and resell it, our business is very simply. She put her question in this format: You bought $100 worth of lumber and sold it for $200. There’s $100 that comes out of inventroy assets but how do you account for the other $100? How did I book that $100? She says she has to make a journal entry to account for the $100 I made on that lumber I sold. I’m just assuming that it shows as gross profit on my P&L. How do I explain how QB accounts for inventory and maybe I need another accountant!

Mary Kay: I’m not an accountant or a CPA, and I don’t know if your “accountant” is an employee or an independent businessperson. Based on your very brief statement, I would be a bit concerned about this person’s understanding of basic accounting, but then this may be taken out of context so there may be more to this than I know about (how’s that for a wishy-washy statement?). I also don’t know how you have been using QuickBooks – you are talking about making journal entries, and if you are fully using QB you shouldn’t need a journal entry. How did you enter the sale?

If you buy $100 of lumber, that is posting cash (or payables) vs inventory assets – assuming that you are handling the lumber as an inventory part (if you are using non-inventory parts, it is a different process). If you sell the lumber for $200 and you are using an invoice, two transactions occur. Inventory asset is reduced by $100 vs increasing COGS by $100. Sales is increased by $200 vs A/R increasing by $200. This all assumes that the inventory part item is set up properly.

Lots of ways of dealing with this, it all depends on how you have set things up.

Is there a printable table of tax lines in QBs, perhaps by tax schedule, to help self-employeds determine which tax line to use for their chart of accounts? And if not in QBs, any other source for a similar listing?

Lynne, I don’t believe that there is a printable listing of this, but there could be one somewhere…

Hello,

I have a sneaking suspicion our accountant is nickel and diming us. She insists on doing quarterly tax returns like the 941 Federal withholding and NYS equivalent herself. She charges a pretty good buck. When I questioned whether most people prepare and file their own, the answer of course was no. If Quickbooks can do the computation and my accounts and journal entries are correct, would it be feasible to do this myself?

That is hard for me to answer. I always did my own tax stuff when I had employees, but that doesn’t work for everyone. The best I can suggest is to talk to another accountant to get a competitive bid? I don’t give Payroll advice here, it isn’t my cup of tea…

P Catalano:

Your accountant might be charging more than this is worth to you. Many businesses do their own payroll and filings.

However, it is a big responsibility, that I suggest you consider with caution.

If you make a mistake paying your utilities bill, they turn out your lights. If you make a mistake in your payroll taxes, it t’ain’t so pretty.

[…] This post was mentioned on Twitter by NewEnglandMultimedia, Shannon Tucker. Shannon Tucker said: @NEMultimedia Not sure if this is quite what they are asking, but check out http://bit.ly/flTCE0 . […]

[…] QuickBooks Tax Accounting for a Small Business – Practical … – I use QuickBooks to manage my small business, and it is tax time. There are a few reports that can help preparing information for my tax return that I’d like to …… […]

[…] QuickBooks Tax Accounting for a Small Business – … – I use QuickBooks to manage my small business, and it is tax time. There are a few reports that can help preparing information for my tax return that I’d like to …… […]