I don’t have a lot of taxable sales in my business, so I only have to report my sales tax to California once a year. Throughout the year I just merrily go along entering my sales into QuickBooks, and in January I run my Sales Tax Liability report. I use that report to fill in the values of my State tax report. QuickBooks makes it simple! However, THIS year, I ran into a problem. The total sales on my Sales Tax Liability report didn’t match my total income on my Profit and Lost statement. What do I do?

I believe that I understand QuickBooks very well, and I understand the rules for California sales taxl. I even understand how sales tax should be set up in QuickBooks very well. However, at first, this threw me a bit. How does this discrepancy happen, and how can I fix it? I’ve not run into this issue before.

The solution was simple – pull out my copy of the QuickBooks 2010 Solutions Guide by Laura Madeira. There it is – a section titled Reports to Review When Troubleshooting Sales Tax Errors. Skimming through that section, I found When Total Sales Does Not Match Total Income. PRECISELY my problem!

There were three things to look at:

- Different accounting basis between reports.

- Non-sales form transactions recorded to income accounts.

- Income recorded as a result of vendor discounts.

In my case, the first and last of those don’t apply. So, looking at non-sales form transactions, Laura lists the specific steps to take to find the errant transaction.

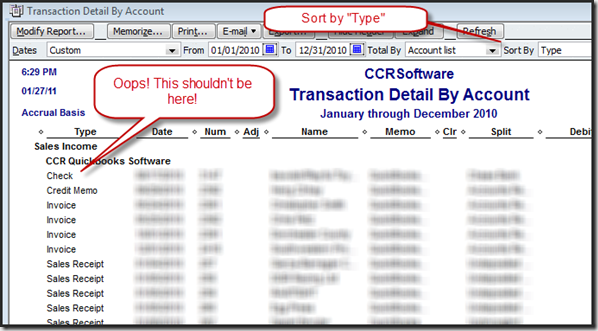

First, in the Profit & Loss statement, double click on the Total Income value. This opens a Transaction Detail by Account report.

In the top of the report window, change the sort by value to Type. Within each account listed the transactions are listed by type.

Sales tax reports look ONLY at sales forms, such as invoices, credit memos and sales receipts. So what I’m looking for are transactions in the sales total that are NOT one of theses types. Sorting by type makes it easy to look for these kinds of transactions.

Sure enough, there it was – a Check showing up in my income total.

I was fortunate in that this check was the only transaction that was in error – the amount matched the difference between the two reports exactly.

Why did I have a check here? Well, I’m getting old, so I goofed. I gave a client a refund, and instead of creating a credit memo, and writing a refund check from that, I wrote a check directly to them and directed it to the sales account that I was reversing. Oops! I know that I shouldn’t do that, but I was probably in a hurry.

It was a simple fix, and I’m very grateful to Laura’s book for pointing out this very simple and direct way to locate the source of the problem. Thanks, Laura!

Wow, two of ‘my best QB Buddies’ in one Blog……Charlie and Laura. Like a great ‘candy bar’, two, two, two goodies in one.

Charlie has indeed ‘hit’ on a common problem, among QB users, and one that many users simply overlook, until their CPA or ProAdvisor notice the issue of sales tax reports generated by the sales-tax items (module), not matching the data those reports should correspond to from the general ledger. And while Laura’s text and Charlie’s blog explain the normal resolution method, I would just mention that this past year, there were some ‘internal issues’ (data or programatic)in QuickBooks that resulted in some sales-tax computation and reporting.

Supposedly the most recent release updates (actually I think R4 of 2011, and R11 (maybe R10) of 2010 were supposed to correct these, so on the year’s end hopefully users’ reports may be ‘technically’ correct even if there were irregularities during the year.

Of course any such irregularities might make the type of problem ID and resolution both Laura presents in her text and Charlie outlines only more difficult to isolate, since even with such corrections sales tax figures might not be correct if users have not ‘updated’ their QB to later releases.

Nonetheless, thanks Charlie and Laura for being such excellent resources in the identification and resolution of potential problems with user data (in this case sales tax issues).

William “Bill” Murphy – Oklahoma City

Bill, that particular sales tax bug was listed as being fixed in 2011 R4. My understanding was that it only affected clients that had very large files. I never had a client that ran into it, myself.

Also, that only was an issue for QB 2011. If you have QuickBooks 2010, there was a different sales tax bug that was fixed in the R5 update, and if you have QuickBooks 2009 there was that same bug which was fixed in the R11 update (see https://qbblog.ccrsoftware.info/2009/12/quickbooks-2009-r10-2010-r4-and-sales-tax/)

I love Laura’s QuickBooks 2010 Solutions Guide! I recommend every QuickBooks user pick up a copy. Don’t let the 2010 fool you. It’s full of useful information even if you’re using a different year.

Charlie –

I definitely was gettin my QB-versions (years) and releases a little out of wack, and indeed there were two different sales-tax issues, but with probably more users still using 2009 versions than having already migrated to 2011, those sales-tax problems associated with 2009, 2010 or 2011 versions may well have haunted the vast majority of users during the 2010 calendar year.

So my intent was to let users know that if they still had sales-tax irregularities after having worked thru the steps you and Laura outline, the cause could very well be their QB application if they were not on a Release that was ‘advised’ as corrrecting those QB-program-based sales tax issues.

Anyway, thanks for clearing up the version and release dates I messed-up on, cause “all the little ‘grey cells’ of this old brain” are fading fast.

Murph

This was a useful article, but it still did not solve my issue with sales tax payable with the QB Online. This client’s sales tax payable shows a large balance due. All payments have been made for the liability each month. I did find a couple items that do not belong in the sales account, but nothing to explain the large balance due. If anyone has any thoughts, I’d really appreciate it.

If the sales tax was paid with a regular check, then the payment isn’t reflected in the Sales Tax Liability. Sales tax Must be paid through the its own process. You can fix this by paying the sales tax using the Pay Sales Tax window to create the payment in QuickBooks. Then change the check number to the one you sent in already. Don’t forget to void the old check. This is the most common reason for what you described.

In The Sleeter Group’s QuickBooks Consultant’s Reference Guide, there is a whole chapter on Sales Tax. In the “Sales Tax Problem Solving” section, there are several troubleshooting steps that help you identify and resolve sales tax problems. I also have a report I created that filters for only those transactions that hit income accounts, but that are NOT recorded on sales forms. That report almost always shows the exact transactions that cause the problems. Other issues could be Discounts taken on bill payments, coded to income accounts, items that do not post to income accounts, checks written for sale tax payments (instead of ST payments).

And yes, there have been bugs in Sales Tax reports in QuickBooks over the years. So make sure you’re up to date on the latest release of QuickBooks.

Hi Doug:

I am having this same problem in QB Enterprise solutions Contractors: 12.

How do I get a copy of your reference guide and a copy of the reports that filters for the transaction that my cause the problem.

Thanks for your help.

Stacy Randall

609-883-8021 ext 302

You can purchase the 2012 CRG from the web site at this link: http://www.sleeter.com/products/crg?utm_source=Practical&utm_medium=Post&utm_campaign=CRG

I have an issue with QB online – Profit/Loss income is markedly higher than reported on Sales Tax Liability. I have found the item that is not showing up in the Sales Tax Liability report – have modified the report to filter for this item and it comes up with a 0! I have gone through the setup of this item and can see nothing different to the other items that work – all are service items, tax free and are attributed to the same income account – but this one just won’t show up – only difference is it is, this item name numerical, the others start with letters! Can anyone shed any light on this for me? I am grateful I have been able to narrow it down to one item but I can’t fix it!!! Cheers and thanks

Well, it appears to be working now when I enter transactions under this item number – I have re-allocated accounts for it – which shouldn’t have been an issue because it’s still under the same major heading – QB asked if it should update all transactions – said yes – but doesn’t appear to have worked – at least it’s probably working from now on! I also changed payment method types etc to no avail – it doesn’t matter if you don’t enter the payment type anyway it seems. Would still be grateful if anyone could help with fixing it retrospectively

Cheers

Sorry, Marion, I don’t work with QuickBooks Online, only with the Desktop product, so I can’t really offer much. QBOE is very different than the desktop product.

Also, you probably are using an Australian version of the product? That again has major differences from the US product, and in this blog we are mostly talking about the US products.

Sorry!

What if total sales under the sales tax report is considerably higher than revenues? My sales tax report shows that I have sales of 340,000 but my income statement only shows revenues for 299,000. What would cause this?

Lots of reasons, Nate – usually because a non-sales transaction is in that report. I gave an example of a check being added to the report in the article, to show the kind of thing that can happen.