QuickBooks has a “Manufacturing & Wholesale” edition, but there is a definite lack of documentation on how to actually use QuickBooks in a manufacturing business. This posting is the first in a series that will give you some guidelines on how to best use QuickBooks in a manufacturing environment. I’ll start off with some basics, and work our way up through some more complicated scenarios.

This is a list of the subjects I will cover – please feel free to comment about any subjects you would like to see added to the list, or which you believe are more important. I won’t cover these subjects in the order listed, although I’ll have to start off with some of the basic subjects before I can get into the more complicated ones. I’ll be adding other topics as we go along, based on user feedback. So let me know what you want to see!

- Creating your Bill of Materials (BOM) – strategies for different situations, limits and capabilities (BOM basics, groups vs assemblies).

- Work In Process.

- Reorder vs. Build Point.

- How to work with highly customized assemblies.

- Working with Outsourced or Subcontract work.

- Pending builds.

- Tracking revisions in BOMs.

- Inventory Costing.

- Understanding the Total Bill Of Materials Cost.

- Shipping Costs and Inventory Valuation.

- Forecasting component demand.

- Dealing with Scrap in manufacturing.

- Manufacturing reports, built in and customized.

- How to use various item “Types” in your QuickBooks Bill of Material

- How to generate job travelers and shop orders.

- ABC Analysis.

- Ways of extending QuickBooks for more complicated manufacturing scenarios.

If you click on the Manufacturing tab in the menu bar you will find a list of my manufacturing tutorial articles.

There are many ways to manage a manufacturing firm, there are many very different kinds of processes that can be called “manufacturing”. Some of my suggestions won’t fit every business – so feel free to tell me if you have a better approach for YOUR business!

Starting with the Basics

I have a mixture of subscribers to this blog, from brand new users to seasoned veterans. So I’ll start with some very basic points for the uninitiated.

Note that I’ll be discussing features in the US Premier and Enterprise editions, and I’ll be using the 2008 version in my examples. If you are using Simple Start or Pro then you really should consider upgrading to Premier or Enterprise. If you are using a non-US version, I’m not sure how much of our discussion will apply to you.

The basic process to get started with assembling items is:

- Create the inventory parts that are components of your assembly.

- Create the inventory assembly and assign it the parts you use.

- “Build” or assemble your inventory assemblies.

Create the Inventory Parts

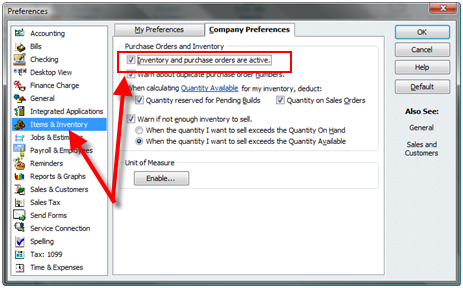

The first step you need to take is to enable inventory management in your company file. This is not set up by default – and it can be confusing to new users because you will see the item list even if it is not enabled. Select Edit from the main menu, then Preferences. Select the Items & Inventory option, the Company Preferences tab, and put a check mark in the box by Inventory and purchase orders are active.

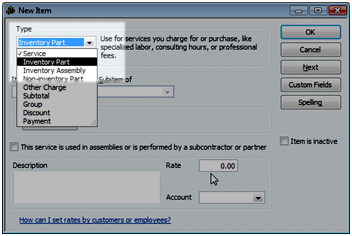

Now you can add your inventory parts to the item list. While in the item list press cntrl-N to add a new item. Note that you have several different kinds of items – we’ll work just with inventory part items now (discussions on how to use other item types will be in future articles).

For each material item that you use as a component in your assembly, add an inventory part. You can also create non-inventory parts for items that you don’t keep track of by count. Please note that we do not recommend that you enter an on hand value at the bottom of the screen at this time, unless you are starting up QuickBooks for the first time and you have taken a physical count of your inventory.

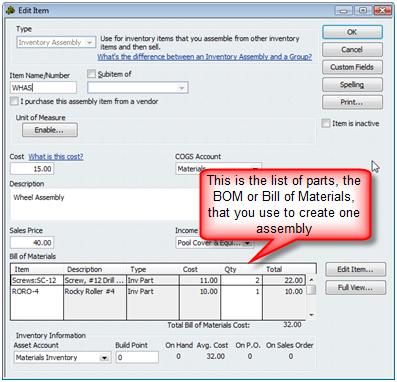

Create the Inventory Assemblies

After you have created all of your inventory part items, you can add an inventory assembly item for each manufactured item. The primary difference from an inventory part is that you can assign a component list, a bill of materials (or “BOM”). This is a list of all of the parts

In this example, to make one “WHAS” wheel assembly we need two SC-12 screws and one RORO-4 roller.

Build the Assemblies

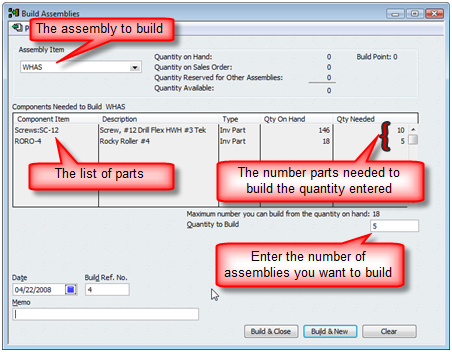

Now that we have defined the parts and assemblies, we can build the assembly. From the Activities button at the bottom of the item list, click Build Assemblies. In the Build Assemblies dialog you will select the assembly to build and enter the number of this assembly that you want to build.

When you click either of the build buttons, the program will save this build (if possible, as discussed below). Two things happen now:

- QuickBooks will remove the qty needed amount of each of the component items (I refer to this as consuming the items in a build).

- QuickBooks will increase the quantity of the inventory assembly item by the Quantity to Build.

Essentially we are moving the cost of the inventory part assets into the inventory assembly asset.

A few comments on what happens here:

- Note the maximum number you can build… value. QuickBooks won’t let you build an assembly if you don’t have enough parts on hand to build it, This value shows you how many you can build with the parts that you have.

- If you enter a quantity to build that is higher than that maximum, QuickBooks will mark the “build” as Pending. This means that it hasn’t been built, it is waiting to be built. There are reports that list the pending builds.

- When you enter the quantity to build much of the information in this dialog will not be updated until you move the cursor to another field, such as the date or memo. This can be confusing at first. When you move the cursor off that field the qty needed is updated, and the pending stamp could be displayed.

-

The Date field is very important. This is the date that the build transaction takes place. This has two important effects:

- The quantity on hand for the component parts is based on your inventory status as of this date. Sometimes people get frustrated – they look at an inventory report and it says you have enough, but this dialog says you don’t! The issue is usually the dates – if the report is dated after a PO is received, but your build is dated earlier, you might not have had those parts on this date. Adjust the date in either your report, or the build.

As you might expect, the same issue relates to the assemblies you build – they are only available on or after the build date, not before.

This has been a quick overview of how to work with an assembly item and to issue a build. We’ll go into more detail about how to structure the BOM, and use other item types, in the future.

To learn more about using QuickBooks in your manufacturing company, click on the Manufacturing tab in the menu bar.

Thanks for the info.

The two serious mistakes I made when setting up was 1) I added in a quantity on hand which made it look like the owner had put in a larger starting investment and 2) I did something wrong with the “Cost” of an assembly item, which has caused strange entries into COGS, can you please address how to correctly enter in the “cost” field of an assembly item.

Thank you. There are two issues here – how to set up the cost fields, and how to set up your initial inventory. I’ll be addressing both of those in future postings (not sure when). I’m sorry that you ran into a problem.

The first error is easily corrected – if you set up an initial quantity and value when you entered the item, you have an inventory adjustment that QB created for you which you can delete. If you can’t find or correct that, let me know.

The second is hard to answer without more detail. Usually the cost of the assembly is generated by the cost of the components when you build the assembly. However, that is a bit of a tricky issue that I’ll be discussing soon. Costing in “builds” is something that is taking me longer to write up than I anticipated because I keep finding exceptions and odd things that have to be explained.

I’m looking for a Pro Advisor in or near Dallas to provide advice and maybe on site training fot the MFG version.

Wow! After nearly 3 months of wallowing in QB hades, you’ve finally made ‘build assemblies’ clear to me!

Thank you so much for this concise and easy to understand information.

Some of the raw material we use in our assemblies have experations dates. Is there a way to track or get an alert notice on the experation date. The tapes and epoxies we use have those. Once the procduct is manufactured the experation date does not matter because of the curing.

Betty, QuickBooks doesn’t have anything like that. No reminders that can be set, and in any case that would be a “batch” or lot control kind of issue because it is a specific purchased lot of the item that is expiring, not the entire part number.

Can QB build a product from set of assemblies that maybe composed of assemblies?

Thnaks

Peter, yes, to a single level. That is, you can create an inventory assembly item, and some of the components can themselves be inventory assembly items (and in turn those can have components that are inventory assembly items). However, when you issue a build for the top level item, the build treats that subassembly just like any other component. The program won’t automatically “explode” the BOM for the subassembly and ask for it’s parts. So if you don’t have that subassembly on hand, you have to first build it, then build the top level assembly.

Please note that my company has a product, CCRQBOM, which can handle that. It will issue multiple level builds, and it will print a multiple level BOM for you. See it at http://www.ccrsoftware.com/CCRQBOM/CCRQBOM.htm – and you can see my product blog at http://ccrqblog.ccrsoftware.info/ which talks about upcoming features.

Charlie,

Great web site/blog very helpful. Could you provide some general advice.

I am about to start trading as a start up manufacturing company and are starting with a clean-slate. We have just bought QB PRO 2009. We have (1) finished product with approx 90 individual parts. We hope to add more finished parts and other aftermarket kits etc as we get going.

Reading most of your site plus numerous other forums it looks like QB Pro 2009 will NOT do what I want from a manufacturing/inventory management point of view. However, it will handle the accounting side.

I’ve looked at the 3rd party offerings and focused on your (which is how I ended up here) CCRQBOM. My initial questions are: –

1. Will QB Pro 2009 handle my 90+ component finished item in a multi-level BOM (I suspect not)

If I go with your product then: –

2. Would I need to populate the item master in QB first or could I do it in CCRQBOM then just synch with QB?

3. Will the CCRQBOM work with Pro or will I have to get your product AND upgrade to Premier?

4. Although your product is not an MRP system – could you confirm I would be primarily using your system to drive my requirements via SO and PO inputs through your system and simply using QB for the accounting and reporting functions.

I think that’s enough for now.

Thanks in advance

Thank you, Paul. I’ve not discussed CCRQBOM in the Practical QuickBooks blog yet, although I’ll have something on that in the future. To see more information on this product you can go to my CCRSoftware product blog, at http://ccrqblog.ccrsoftware.info/2008/12/ccrqbom-upcoming-features/

1. QB Pro won’t handle your BOM, because Pro doesn’t support an Inventory Assembly item type. You must upgrade to either Premier or Enterprise to get that feature. Premier can handle 100 component items in a single BOM, Enterprise can handle 500 component items.

2. CCRQBOM works with the data in QuickBooks, it doesn’t keep its own BOM. You would enter your inventory assembly items and their BOM’s in QuickBooks, just as described in the article here.

3. As I said above, you need Premier or higher. CCRQBOM won’t work with Pro because you need the inventory assembly item type.

4. You would enter your sales orders and purchase orders in QuickBooks. The current release of CCRQBOM lets you print multiple level BOM’s (which you create in QB, but QB won’t print full levels) and see basic requirements. The article I referred you to talks about upcoming features in CCRQBOM that start to look at SO and PO information.

Feel free to contact us about CCRQBOM at either the CCRSoftware blog (http://ccrqblog.ccrsoftware.info/) or via email at sales@ccrsoftware.com

Having a prob with s/o’s and invoices. We use non-inventory designation on our items, as we keep no inventory. When I create an invoice from a s/o, but only partially ship, I am having many probs. Why do I have to mark everything NOT shipping to 0 qty, instead of just marking what shipped with a qty? Why does the invoice print out with large gaps where the non-shipped items would be, instead of printing what was shipped from the 1st line down??!! I can’t see a solution in template.

How do you handel the labor part of a subassembly?

Robert, that isn’t a simple question to answer, and I should write an article on that. The answer does depend on a number of things – such as if you are running QB Payroll, and how you want to account for labor. You can, if you wish, add a service item for labor and have it post to your labor expense accounts, but you also have to talk to your accountant about how they want to handle labor and manufacturing costs…

Your link for Inventory Costing. {https://qbblog.ccrsoftware.info/2009/01/understanding-…inventory-costunderstanding-quickbooks-inventory-cost/} Does not work. removing the three dots in the middle does not work either.

Ken, I’m not sure which link you are clicking on, where in this page?

Is there any way for the Build Assemblies form (or any other form) to give me a list of the items I am short and the qty short of each item when I enter a Qty to Build the exceeds the maximum. It’s such a simple and obvious requirement, it must be there somewhere.

Dave: Simple and obvious, but they don’t provide it. You can do three things:

In the “build assemblies” screen, you can visually see the quantity on hand and the quantity needed, and you can do the math yourself.

If you enter a build as “pending” you will see the needed quantities showing on the Inventory Stock Status by Item report – see my article about this at https://qbblog.ccrsoftware.info/2009/05/quickbooks-manufacturing-forecasts-component-demand/

You can go to a third party program, of which there are several. You may want to look at my own product, CCRQBOM, which provides you with that kind of report. I wrote this specifically because I was frustrated at the inadequacies of QuickBooks for manufacturers.

I buy leather and hardware, and use contract labor to make leather handbags.I am a new QB mfg 2009 user and followed instructions on how to set BOM, assembly and build. However, when I got to the point of build I received a warning message “One or more service, non inventory or other charge item will not be included in this build because the item does not have an assigned expense acct”. I checked all lines in BOM and every line HAD expense acct assigned. I have to say that I included line in BOM “labor cost”, it is fixed cost for me, and assigned “sub-contract labor” expense acct. After I proceeded to “build” my QB said” will not be able to build, have to restart” and restarted my QB. Item was not build. I tried a couple of times- the same result. Is anyone can give me an idea how to finish my build? Thank you.

Diana, take a look at this article in my other blog web site. Examine your BOM’s for “blank lines”. Delete them if you find them.

http://qbfaq.ccrsoftware.info/2010/01/14/quickbooks-shuts-down-when-issuing-a-build/

Thank you, Charlie. There WAS a blank line, and after I deleted it, I was able to build my item. I really appreciate your help. Regarding your blog in general, the information you posted on your blog is exactly what I was looking for, and finally, as soon as I discovered your blog, all this QB finally started to make sense.

When I built the assembly, I forgot to include one important piece. How can I edit? QB help suggests to find a transaction (I did) and adjust it. I am not sure how I can do that, because all lines are not “clickable” (2009 MFG Premier). Thank you.

Diana, you can either delete the “build” transaction and then change the BOM and re-do the build, or you can do an inventory adjustment to consume the part and put the value into the value of the assembly. Note that deleting the build has some potential side effects if that assembly was in turn used in another build.

Excellent information. Thank you. We have set up an assembly and have included labor as a service item. Everything is working correctly, with the exception of the average cost is not accurate. For example, if we build two or the same assemblies, and the total labor for we entered when creating the assembly was let’s say $10.00, in theory the average cost of the assembly should reflect $20.00 (2 produced x $10 each). It is not reflected this way. It is only reflecting $10.00. It seems that no matter how many we build, the average cost only reflects qty one. If we look at the transaction journal for the assembly we built for two, it accurately reflects the two built.

Thanks for your thoughts,

Gary

Gary, hard for me to say without knowing exactly what the BOM contains and what the accounts are that you use in each item. I’m not seeing what you say in a quick test, but probably I have something set up differently than you.

Is the labor item a “two sided” item?

Great Website! Thank you ahead of time. I need to up-grade from Pro, but feel like Enterprise is over kill. Can you compare Premier to Enterprise. We are doing basic manufacturing of 2 to 10 components that we are putting together to build a finished item that then needs to show up in inventory. 1) I need to be able to track COGS to make sure that we are charging enough over time. 2) I want to be able to build a PO and have a parts list generated so that I can order the components that I need. Thanks.

Jewelry Builder, I can’t answer that fully in just a comment here. The differences in Premier and Enterprise in relation to manufacturing are primarily the ability to edit the template for the build report, and the ability to change the BOM on the fly when you issue a job. There are other differences, but those are the keys in my mind (for manufacturing). And this is only in the 2010 version (not older). Also a BOM can have 500 components in Enterprise but 100 in Premier. Tracking expenses can be done (essentially the same in both), but generating parts lists might be an issue depending on what you are specifically looking for.

Lots of useful information…particularly in your responses to comments. Building on the question from Jewelry Builder, I plan to upgrade from QB Prem 2006 to a 2010 version. Have a similar component build needs using 2 to 10 components in assemblies and am looking for more capability in inventory tracking than I currently have. Do you recommend I purchase QB Premier Manufacturing or can I just use QB Premier 2010? What are the major new functionalities going from ’06-’10 with respect to manufacturing?

Becky, I don’t recall any specific features in Premier that relate to manufacturing that has changed from QB 2006, off the top of my head.

Get the manufacturing version rather than the “generic” version, because the generic non-edition version has some limitations relating to unit of measure – see this article in my companion blog: http://qbfaq.ccrsoftware.info/2009/10/26/unit-of-measure-support-in-quickbooks/

Thanks, Charlie. One quick follow up…Couldn’t I get the Premier Accountant version (same price as Prem. Mfg. and Wholesale) plus added features of the Client Data Review and more robust for financial accounting? It seems from all of the charts that I would still have all of the manufacturing functionality, and since I already have my chart of accounts, the only thing I may lose is mfg. industry reporting. Or am I off-base here? Mainly, again, concerned with assemblies and tracking inventory. Thank You.

Becky, the Accountants Edition is an excellent choice for you. You have access to all functionality of the Mfg/Wholesale edition. I mention that briefly in my article at https://qbblog.ccrsoftware.info/2009/11/should-i-select-quickbooks-accountant-edition/

We track all units during manufacturing and after shipment to customer by Serial Number. Does QuickBooks for Manufacturing have any mechanism or workaround to track Serial Numbers and lok them up afterwards? We offer a one-year warranty and I use Serial Numbers to track units back to time of shipment, so that I can determine if a repair is in or out of warranty. Currently, I paste a table of Serial Numbers in the body of a regular QuickBooks invoice, but I don’t have ny way to search and find them afterwards.

Brian, QuickBooks does not have a serial number tracking feature. Some addon inventory packages do, but you have to manage inventory outside of QB for those to work. You can add custom fields to the invoice and enter serial and date info there, and use the advanced find feature to locate them, but it might not be as flexible or as quick as you might want…

How do I create a Debit Memo for a vendor that you can print and send to the Vendor; along with deducting it from your inventory? Please help! I am working on 2009 Premier Manufacturing & Wholesale Edition

Thank you

I don’t know of a one-step option to do that.

You can select “enter bills” and then select the option at the top of the form to make it a “credit”. Enter the items in the Items tab. That will create a reversing entry. But it won’t print a form.

You can then either create a PO using a modified template that states that it is a return, print that, and delete the PO, or you can use the Non-Conforming Materials Report (in the Mfg & Whlse menu under Inventory Activities).

Hello there,

My company uses QB Pro and I have recently joined and am trying to make heads or tails of things (it is a 2 person operation at this time, the owner and myself). The accounting system has been in place for some time. The parts list appears to mostly be categorized as Sales and Revenue rather than COGS for assembly items. (There are times when a handful of items comprising a full assembly are sold as replacement parts but this is somewhat rare). I fear this may be detrimental from a tax perspective but frankly do not know accounting at this level. Do you have any advice for me on resources that I could leverage to assist this company in getting a handle on this going on the assumption that the company does not have resources at this time to do any upgrading of the QB software or bring in an accounting pro. The tax accountants are insisting that we provide a clean inventory with the QB file and I really have no idea where to start to get it cleaned up!!!!

Michelina, keep in mind that if you have Pro you don’t have “inventory assembly” items so most of the manufacturing concepts outlined here won’t apply.

I’m not a tax accountant or CPA so I can’t offer you direct advice there.

No cost consulting options are limited. The best I can say is you can ask questions in the Intuit Community Forum at http://community.intuit.com/forums

Charlie,

Your site is incredible. We are in the process of establishing inventory guidelines in our baking/manufacturing business. Most of our assembly builds will need to include different types of measurements. For example we use X lbs of flour, X lbs of butter, X cups of water, X tbs of salt, etc. Can you point me in the direction to obtain guidance on this type of build?

Heidi, I can’t give you much more help without more info on what you want. You have to decide on the unit of measure for the baked good – is it going to be an “each”, or a “dozen”, or what? It should be the smallest unit that you will use to sell by. Then you need to make a bill of material (or recipe, if you wish) for that unit – how much of the items that go to make one base unit of assembly. This is NOT the way most bakeries think. Usually you will say something like “I’ll sell by the “each” for a cookie, but my recipes are to make 10 dozen cookies”. QB doesn’t work that way. I am working on a modification to my CCRQBOM add-on product for chemical manufacturer where we have a “yield”, so you can sell by each but have a recipe for a larger batch.

I understand. We have broken down each of our recipes and calculated the yield to establish the number or units we are creating with each bake. We purchase our raw ingredients in large quantities ie. Flour, 50 lbs, butter case of 36 lbs. When we make a recipe, we calculate into pounds, ounces or grams. Once we were to convert the item to our selling units, the portions of each of our ingredients is measured in grams. We were just trying to enter Inventory Assembly/Unit of Measure and wanted to allow for pounds, ounces and grams. We also wanted to add an item for 50 lbs, which would be how we purchase and the program calculation guideline requested a measurement between .001-5000 grams. in order to use a 50 lb bag, we need to enter 21,679.6185. Do you have a suggestion?

Can you steer us toward a step by step procedure for us to execute this project?

Heidi, I don’t have a specific procedure to refer you do. There are a lot of issues involved, and decisions you have to make. These are usually addressed on a case-by-case basis. You have pointed out one of the big problems with trying to deal with recipes in QB when you are buying items in large bulks and then trying to generate a BOM for very small amounts. QB isn’t well suited for that.

In very general terms, you either have to decide that you don’t need to actually track inventory at that level, so that you don’t need to create the recipes in QB, or you have to deal with manual “yield” calculations. Set up the BOM for a larger batch, then make an adjustment to correct the number you build. I have been working with one chemical manufacturer client on dealing with “yield” calculations like this, along with my CCRQBOM manufacturing addon.

Hi there,

I have QB Wholesale 2009. I have 3 sales reps that I pay a % of the wholesale orders they bring in. I have dubbed them reps, as emplyees housed in the employee center. Is there a way that when I list them as a rep on a sales order, the commmission will automaticly apply and show up somewhere for me to see and account for?

Thanks!

Megan, that is WAY off of the topic here. Commissions are based on invoices, not sales orders. If you search the QuickBooks help file on “Commission” you will see how it works – you would look at the sales by rep summary report.

Hello… Lots of great info, THANKS ! I am using QB manufacturing for bookkeeping and inventory control in a boat sales and service yard. the inventory and bookkeeping seems straight forward but i am trying to keep track of boats we have, i add items to the boats when we are fixing up used ones or adding items to new ones… i dont actually build the boats so i start off with a product and add to it .. So how do i do this, i have so far made a inventory assembly with the vin number of the boat as the part number and add all the items in the assembly parts field.. do i need to add the actual boat i started with in that field as well … i orginally thought i could put the price i paid for the boat in the cost field( of the main assembly) but that messed everything up. So if i have to put the boat in the area with all the parts what should i call it? should i use the same vin number with just a extra letter at the end…. sorry for the long question but i cant seem to find anyone else who is trying to use this for what im doing… Thanks Anthony

Hi there, i have a tee shirts wholesale business, its very easy for me to make a invoice with the total quantity purchased, but very hard to deduct my inventory by the size,colr,kind and then the design, i do take orders on exel sheet, where it is easy to write, i guess, what my question is that is there any add on/softwere available in QB for wholesale and MFG, that can convert the sales order from exel into invoice and deduct the inventory at the same time.

I don’t know if this would do what you need, but you can look at the Transaction Pro Importer from Baystate Consulting (https://qbblog.ccrsoftware.info/2010/01/importing-quickbooks-transactions-with-transaction-pro-importer/)

Or, QuickBooks POS has an inventory that handles a “matrix” kind of inventory, to handle size (etc) variations.

Anthony, sorry I skipped your question.

if each boat is different, unique, you wouldn’t use inventory assemblies. There are several ways to approach what you are trying to do, but it is more complicated than I can describe here. You really should work with a ProAdvisor who understands QuickBooks and your kind of situation. A lot of this depends on how many boats you go through, and how long it takes to fix them up, and how long you hold on to them, and more. But Assemblies are probably not the way to go.