What is the “cost” of an inventory item that you purchase? For many businesses we talk about the “landed cost” of the item, which can include not only the purchase cost of the item, but also the shipping cost of the item. In this article I’ll talk about a few ways to handle this in QuickBooks.

The landed cost of an item is usually considered to be the cost of the product plus any relevant logistics costs, such as transportation, warehousing, handling and so forth. The can also be called the total landed cost or net landed cost.

For my example we will receive an item called sprocket. We’ll receive 10 of them, with a unit cost of $10.00, plus a shipping fee of $10.00 (sorry about the unoriginal values here). If we were to just receive the items our item cost would be $10.00 each, but what we want for a landed cost is actually $11.00 each.

Shipping Billed with Item

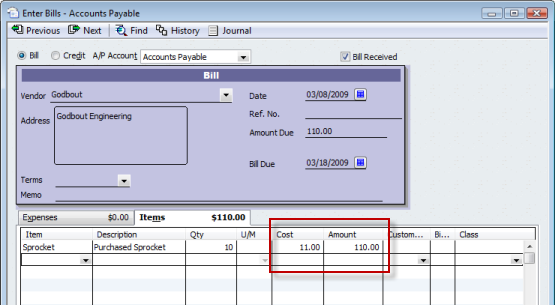

If you receive a bill for an item and the shipping is included in the same bill, you can do a little math in your head to include shipping in the item cost. Let’s look at a receipt of an item, with the bill:

I received 10 at $10 each, plus a shipping fee of $10, so I simply enter a total cost of $110.00. If you have several items in the receipt but one shipping cost you have to allocate the shipping cost to each of the received items yourself.

Shipping Billed Separately

What happens if you get the shipping bill later? Perhaps you are paying a separate company for the shipping fee so it doesn’t come in the bill for the items themselves. There are two ways to handle this.

- Go back to the original item receipt and adjust the amount to reflect the shipping charge. This works if the shipping charge comes from the same company, and you don’t mind adjusting the original bill to include these charges. This is a simple approach, but generally not the best way to handle things.

- Create a special shipping clearing expense account to use when entering the bill, and then doing an inventory adjustment. This will deal with most situations properly, but it does take extra work.

A clearing account is one that you set up in your chart of accounts to help with the process of moving a value from one place to another. Generally the idea is you create a place to hold the value, and then you adjust it away so that the clearing account doesn’t have any value left behind.

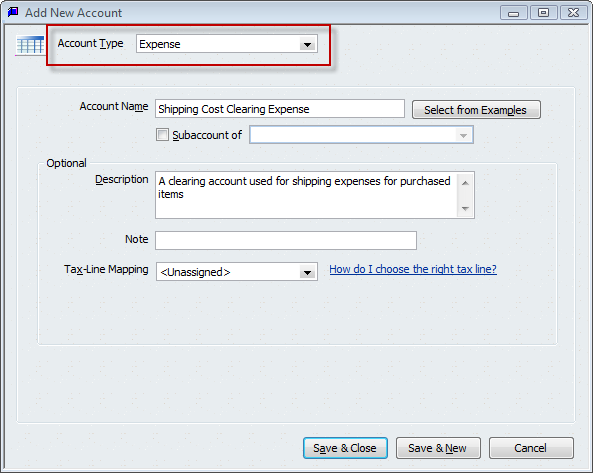

In your chart of accounts create a new expense account and call it Shipping Cost Clearing Expense.

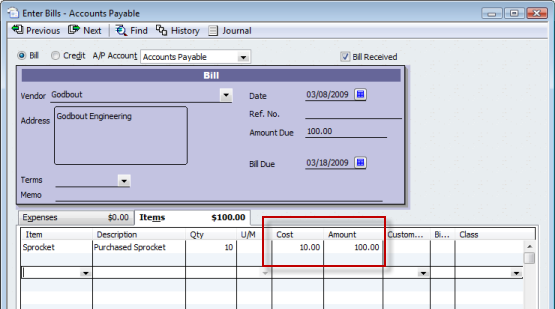

You will receive the item as before, but since we either don’t know the shipping cost or the shipping charge is from another vendor, you will only enter the actual purchase cost of the items. In this case, we enter $100.00.

As you can see below, we have an average cost of $10.00 per item (in this case, because we didn’t have any on hand prior to this transaction).

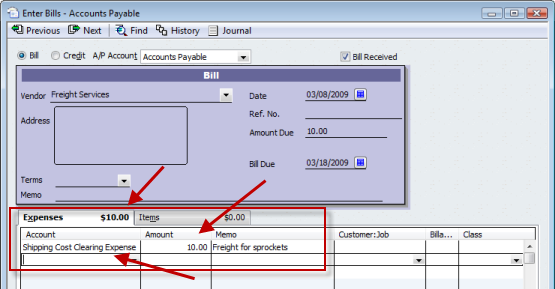

Later we receive the shipping bill, and we will enter the cost of the shipping ($10.00 in our example). They key here is to use the clearing expense account, rather than your normal shipping expense account. If you stop now, you have expensed your shipping, you have not allocated the cost to your inventory.

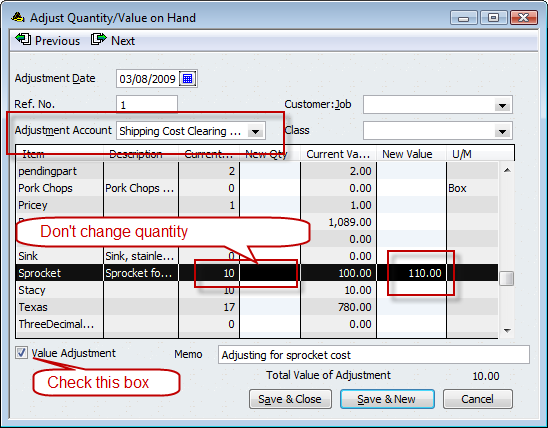

Now you are going to enter an inventory value adjustment to move the shipping cost out of the holding account and into inventory. Do not change the quantity. Make sure that you:

- Select the shipping cost clearing account for the adjustment account.

- Check the value adjustment box.

- Enter a new value amount that is the total of the current value plus the shipping charge.

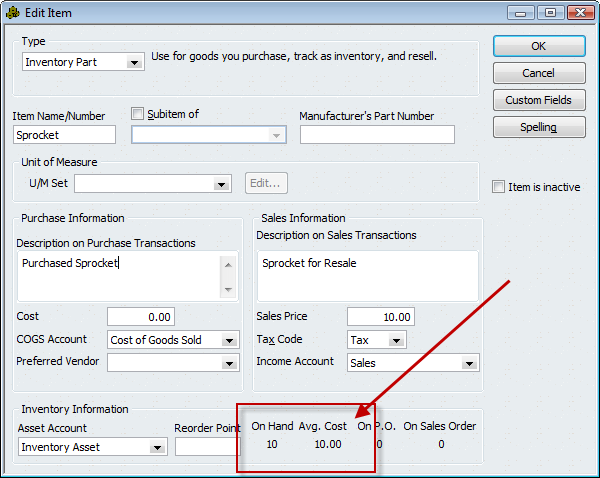

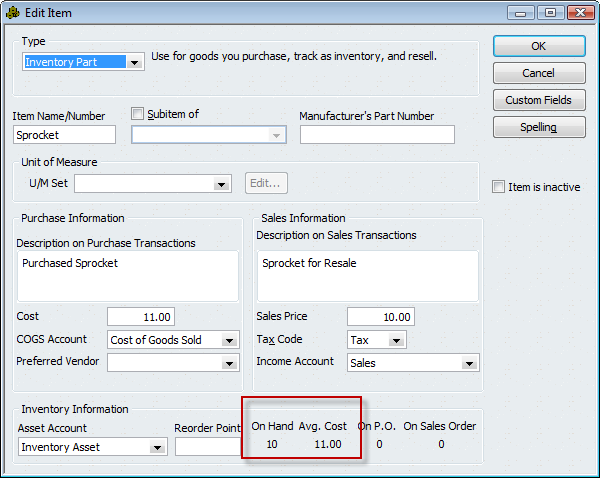

This moves the cost from the holding account into your inventory asset account. If we look at your item you will see that the average cost is now $11.00, which was our target. PLEASE NOTE that if you have existing items, or multiple receipts, you won’t see this as clearly. BUT the process will still work correctly if you follow the steps above.

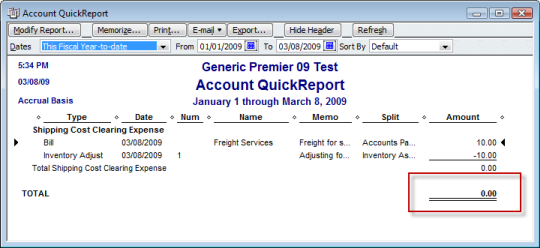

If we look at a QuickReport for the clearing account we see that the net balance is zero – which is a good check to see that all of our inventory adjustments have been entered for these kinds of situations.

Hope that helps!

Great post. I handle shipping similar to the way I do use tax. On the original invoice I gross up the item cost for shipping, then add a negative line (on the expenses tab) to back it back out. That line goes to the same GL account as the subsequent shipping invoice.

It has the unfortunate side effect of having two bill lines when the customer only actually billed one line. It’s a preference, though. I think they’re both good methods. Whatever gets the right answer, right?

Hi Charlie,

On a new subject: You are probably aware of the new COBRA requirements for employers. We have to pay 65% of the premium, which is declared on the NEW Federal form 941 (quarterly payroll report), and REQUIRED first Qtr 2009.

My question is: Is Quickbooks going to have the new form available, and how do we enter the info to properly populate the form 941?

Thanks for all your great info – Donna

Hi, Donna, hope all is well up in Woodland: Blog discussions like this aren’t a good way to talk about off topic subjects. At this time I don’t have an answer for you as I don’t usually work with Payroll. You should try contacting Intuit payroll services about this…

Charlie,

Excellent info, as usual. In the scenario below, how do we get our PO to match the invoice so that the invoice can be paid?

1) Issue PO for 10 Sprockets at $1/ea

2) Receive goods in total

3) Receive Invoice for $10 goods + $10 freight

4) Pull up PO to pay, value on PO is only $10.

I’m not in accounting…just was asked that question after showing your solution for costing goods to include freight.

Thanks in advance,

-Ray

PS CCRQBBOM is so very useful…thank you for this great product!

Ray: Two easy ways, depending on how you are treating your shipping costs.

If you are expensing them, then on the receipt transaction you selec the “Expenses” tab (your items are probably on the “Items” tab) and add the expense to the appropriate account.

If you are doing the “landed cost” approach I discuss above – on the item tab you just change the “amount” value to be the total amount. If it is one line at $10 of goods, just change it to $20. If you have several lines, then you would have to manually divide the amount out amongst the detail lines, adjusting the amount of each.

I’m glad that you like CCRQBOM, the April release (if I can quit writing blog postings and get the documentation finished) will add a LOT of capability. Subscribe to the product blog and you will be notified when the new release is ready.

Charlie,

Using Ray Leventhal’s question, the vendor balance will show $.20/- whereas only $.10 is payable to the vendor. What should he do in this case. Maybe dick’s answer will be more appropriate.

thanks

Shiraj: Ray’s question had him receiving the item but getting the bill later. The bill was for $20.00, and if you make the adjustments like I suggested, the amount due is $20.00. That is the correct amount.

Hi,

I understand the landed cost adjustment. I have set up an account “Customs Clearance” which I have paid as a cheque as COGS and I understand about making the adjustment on price. Can I do the adjustment on that “Customs clearance” account? Or should the customs clearance been set up as expense instead of COGS?

Thanks

Chris, that is a question for your accountant. In my view (not being an accountant), the big difference between expense and COGS is where it shows in your financial statements – “above the fold” or below. If you do what I’m saying, it doesn’t matter in the long run, because you are “clearing” the account – posting a value there and then clearing it out with an adjustment, so if you have all your bills in the value should be zero. Hope that makes some sense.

Hi,

My problem here is the other way around, I’ve been Learning QB on my own…very badly lol, but I kind of sorted things out except for one thing, when I create and Invoice, how do I had shipping costs to it? I do not wish to have my shipping costs on the product net price (the landed product stuff), I wish to have a specific product or expense in the Invoice to represent shipping costs. Is this possible ?

Regards

João S.

João: This article is talking about the cost of shipping that you are paying to RECEIVE an item. You are talking about the cost of shipping to SEND an item to someone. That is a bit different. Normally your customer is bearing the cost of that (unless you decide to cover it). If you are charging shipping costs to your customer, create a “shipping” item in the item list, perhaps as an “Other Charge” item, and add it to the invoice as a separate line.

HOW TO ADD IMPORT DUTY, FREIGHT ETC TO COST,IF BOUGHT MULTIPLE ITEMS ON ONE VENDORE INVOICE. IF ITEM A 50 PCS @ 5.00, B 10 PCS @7.00 AND C 15 PCS @20.00.ON THAT FREIGHT PAID 500.00 DUTY 200.00 DEMRAGE 100.00 (ALL TO DIFFERENT VENDORS)

Noor, if it is in one invoice, you have to manually determine what percentage of the costs go to each item. This is not always a simple task.

Hi

I expand the question of Noor, we have 3 or 4 different costs to one item like unrecoverable taxes, duty, freight, services etc. Do we need to use separate clearing accounts for each item? What if we want to see our all taxes, duties, freight, services in a specific period?

I don’t want my accountant to see the actual price of the product and want accountant to just post and adjust costs other than product price.

Tariq, you can do it however you want. You can use one clearing account, or separate ones. Separate means that you can see more detail on your financial statement, and works better if you have some costs that take longer to come in than others. Combined generally means less visibility for individual costs but it takes less time to implement. I suggest that you set up a test file and try it each way.

If you give the accountant the ability to post these details, it is very unlikely that you will be able to prevent them from seeing the other details, with Pro or Premier. You might be able to restrict the accounts they see using Enterprise, but I’m not sure that will be adequate. I haven’t played with that aspect.

Hi Charlie,

In some cases we don’t get the invoice for the items received until after we have closed a month at which time we find out there was shipping added.

Is there a way to have the shipping update inventory in the current period and not go back to the previous period to make the adjustment?

Thanks,

Dan

Dan, yes and no. It is a bit complicated to spell out in a comment. There are a number of different ways to handle it, but you should talk to your tax accountant. You could enter the bill at the time that you receive the item with your expected cost, and then do inventory value adjustments when you actually get the shipping bill. Rather than change the unit cost of the item back at the time it was received, you can just post the cost to inventory asset on the date that the invoice is received (current period). But that isn’t a “tax” person’s answer. This puts that shipping cost in inventory, so the COGS when you sell the item is put into the current period. Hope that makes some sense…

Dear Charlie,

Your approach is a good approach that I have used. However, I have a problem when the shipping/clearing bill comes in a different accounting period. I received the goods in 2008 and I received the shipment/clearing invoice in 2009. When I do the adjustment on my inventory, I had to do it with a 2008 date, since by the time my shipping invoice came through, the products where no longer in my inventory (they had been sold).

The problem comes at year end, when in 2008, the Clearing Account shows a negative in my income statement and will show a positive in the 2009 Income statement. How would you deal with this issue. Would you do make an adjustment in the General Journal in order to “Zero” the balance of the Clearing Account, against “Retained Earnings”?

What would be the optimal solution?

Thanks

Ramis: As I’m not a CPA I can’t say what would be best from an accounting standpoint. From the standpoint of your year end financials, you could do a journal adjustment at year end and then reverse it in the next year, which would be a fairly simple solution. Have you talked to your accountant about this? Unfortunately, it is a bit of a hassle no matter what approach you take.

Charlie,

Thank you for your post on handling the application of shipping cost to the inventory account. I am currently right in the middle of creating a QuickBooks video tutorial for an introductory QuickBooks class at BYU-Hawaii in which students will be required to record a purchase of inventory that includes additional shipping costs.

Your solution (landed cost) was right on the money and will help me improve the video I created at 11 pm last night.

I guess I better start my revision. All the best.

Kevin Kimball

Kevin: Great! I’d love to see the video…

Charlie,

Thank you for this site and your very helpful advise and direction. Although I have tried to follow this post to solve my clients issue unsuccessfully, well, maybe if I stated it directly you could respond in kind. They are adding freight charges on their PO’s and they are set up as Freight being an inventory item posting to Purchase COGS and Sales income account as well as a other current asset called “Inventory Asset”. When we run the P&L it appears that the freight has been severely over inflated and terfore their COGS completely incorrect. Have you seen this type of error before and if so, can you advise how to correct it from the past as well as going forward? Thanks so much for your time!

Jim, I can’t say what specifically to do without seeing the file itself. However, having “freight” as an “inventory part” item is, as far as I’ve seen, very unusual. Why would you do this? You aren’t reselling that “freight” item. It won’t put that cost into the cost of the received item. If you receive that item the cost goes into the inventory asset account, and it would stay there. The COGS account is only accessed if you sell “freight” on an invoice. Very strange…

I understand the way you are showing how to deal with the shippingt, taxes and other expenses to add to the cost of the item. But I want to know how would I know, after I have cleared this accounts, which porcentage of the cost of the item, is from shipping, which is from taxes. And I still don´t understand how to deal with making the value adjustment when you already have the same items in inventory which were bought at a different cost.

Thanks for your posts.

Why do you need to know what percentage of a particular item’s cost is shippig and what is taxes?

As far as value adjustment, read my inventory adjustment article.

Hello Charlie

I have decided to use the “landed cost” approach when entering my PO’s. How should i enter reimbursable items?

For example, i buy 40 bags of x and 40 bags of z, shipping charge is $10 and 2 pallets at $16 each(the bags are shipped on pallets). I will be reimbursed $13 upon return of each pallet, leaving me a cost of $3 per pallet. Should i include the cost of each pallet($3)into the inventory items the same way i would do for the shipping charge? How would the amount on my PO match the bill if i pay $16 first?

Thank you so much!

Navid Shariati

Navid – here is a thought:

If you put the $3.00 into the cost of the item, as you suggested, create another ‘other charge type’ item for the “Pallet deposit” and point it to a current asset account.

Then, when you get the bill, enter the inventory item amounts, including the sh/h and pallet fee ($3). Using your new item, add the pallet deposit($13).

Then, when you are credited back the $13, use the item to record that, as a minus on the bill (or a sales receipt, if they give you a separate check).

On your books, you should always have a current asset balance of the amount owed to you when you return the pallets. ($13 x # pallets in your possesion)

Try this and let us know if it will work for you.

Thank you, Laura.

Navid, Laura is an expert in QuickBooks and accounting, and I asked her if she would respond (as I’m not a bookkeeper or accountant).

Charlie,

Thank you for your landed cost example. However, I see that the item “cost” has changed to $11.00 as well as the “average cost”. Is this what you want? Wouldn’t your next purchase order use this new cost and might be overlooked? I am a new user using QB Premier 2010 and have encountered this issue.

Kathleen – sometimes when I’m working with my sample data, some things get changed that are outside of the example. That may be due to my having to run through several scenarios at one time. If you follow my example step by step the “cost” would not change, just the “average cost”. You DO want the average cost to change. The “cost” itself won’t change when doing the value adjustment.

Thank you for your quick response and patience. Still trying to figure out how Quickbooks works and really appreciate this web site. I am learning lots of things to include in my setup and lots of things to avoid. Am migrating from another software system and trying to be open minded about the differences. Beginning to appreciate Quickbooks’ flexibility and power.

Hello Charlie,

I know I’m not in the right category but I didn’t see anything for general questions. I want to know if 2010 M&W QB supports 2 shipping locations. We sell wholesale landscape lumber and each “yard” has most of our inventory items but one yard also manufactures chain link fence. If QB is NOT happy with 2 locations, is there some add-on software that would support it?

Thanks for your help – this site is SO informative!

Nancy

Nancy, glad you like the site. This isn’t really an “open forum” kind of site, where people can ask questions. I write articles on topics of interest (that I know something about). The Intuit Community forums are a good place to ask general questions (http://community.intuit.com/quickbooks)

QB doesn’t really handle multiple locations. The primary issue is keeping inventory separate. The best you can do is to create part names that divide by location – so instead of having “pine board” you would have “Yard 1 Pine Board” and “Yard 2 Pine Board” or some variation of that approach. It is a pain.

You might look at Fishbowl Inventory, it allows for multiple locations I believe, but that is expensive. It keeps the inventory outside of QuickBooks (I’m not endorsing it, as I don’t use it so I am not familiar with it in detail).

Thanks! Appreciate your time and will wander back to the “Community” but glad I found you and your great site!

Nancy

Hi Charlie,

GREAT post and blog, thanks! I have a quick question involving Scenario #1, wherein shipping is billed along w/ the cost of the inventory items. I completely get the concept, but what if we’re not working w/ even numbers, i.e, $10 for item, $1 for shipping?

We buy our inventory from a Canadian company, so we also have to spread foreign exchange rate loss/gain across our items, along with the shipping. This is perfect in theory, except for rounding…

For instance, with one invoice, I’m off by $0.04 now after spreading the shipping and FEX difference across each item. I haven’t started using this method but I’m all on board to do so, except for this one niggling question I have. How do I deal with these small amounts by which I’m off?

I can play around with the numbers and add one or two more decimal places to eventually get it all to come to the right total charged amount, but it takes a lot of time. Any suggestions or is that pretty much just how it goes? 🙂

Again, thanks for this great resource — I’ve learned alot here!

Brittany, there are a number of ways to deal with it, but you should talk to your accountant for guidance (and please note, I’m not an accountant).

Personally, I want to avoid things that take a lot of time. And worrying about $0.04 isn’t very productive. I would set up an expense account (or whatever your accountant suggests) and just post the rounding error values to that account. The amount isn’t significant, and since the dispersion of these values across multiple items is a guesstimate anyways, I don’t see that it is any less accurate to do this. Often when dealing with multiple currencies you have to set up an account to handle all kinds of variances due to exchange rates, and this would be a similar concept.

Again, though, I’m not an accountant so you should as for professional guidance on how to handle that in your situation.

great website. thanks for the help!

if we move the shipping cost to the cost of the item, from $10 to $11….. Will that change the cost of the 10 units for the next PO that is created…….since our vendor price is still $10 total for 10 units..should i send him a PO showing the $11 for the 10 units…what will he think…..and perhaps the shipping cost changes, too……..can the shipping cost be capture some other way without having to make inventory value adjustments……..you might have 10 to 20 inventory items on a PO……….Lou

IN my last comment about shipping….it should have been $10 per unit, not $10 for 10 units or $11 per unit, not 10 units…the question is still the same….

Will that change the cost per unit for the next PO that is created…..will be $11 ? or

should i send him a PO showing the $11 per unit…what will he think…..and perhaps the shipping cost changes, too……..you might have 10 to 20 inventory items on a PO….could be tedious work…….can the shipping cost be capture some other way without having to make inventory value adjustments………….……….Lou

Lou: You always have the option of expensing the shipping cost (I’ll not argue the “accounting” aspects of this). If you want to include the shipping costs in the cost of the item, you have to do some sort of transaction such as an inventory adjustment, or changing the received unit cost.

But, please note, that this changes the “average cost” of the item. That is different than the “cost” field. When you add the item to a new PO, the default “cost” that shows comes from the “cost” field, not the “avg cost” field. So if you don’t change “cost” in the item record, you don’t affect the future purchases.

When you first start using PO’s and receipts, if you receive an item at a different unit cost, a popup window appears that says “you have changed the ‘cost’ for” this item. It asks you if you want to update the item with the new cost. You can say yes, or no. Say no to leave it unchanged. Note also that this has a check box that asks you if you want to suppress this question in the future. If you check this, then the answer that you give becomes the “default” answer.

So if you are changing your unit costs and that change sticks in the item “cost” field, you have answered that question “yes”. If you want to change that default answer, you have to reset the “one time messages”. See this article on how to do that: http://qbfaq.ccrsoftware.info/2009/10/26/how-do-i-get-those-quickbooks-warnings-back/

Let me know if that is clear…

We sometimes receive hundreds of items on a PO. As for freight charges we do divide the freight as a percentage across all items on the PO. How can Quick Books do this for me so I dont have to add the percentage to each individual item manually.

Nic, I don’t know of a way to get QB to do that itself. A custom program could be written to do this, but I don’t know of a better option.

Hi Sir,

I am appointed a new accountant here. They are not adjusting inventory prior. From now on i want to adjust inventory cost which included shipping cost your advise works only when we dont have any quantity on hand. is there any way to adjust shipping cost when we already have quantity on hand but which only effect the new items?

thanks

HRS – this works perfectly well if you already have a quantity on hand. Prior to including the shipping in the cost of the items, your shipping cost most likely was being expensed. If you start using these methods, from this point on your shipping cost is being built into the cost of the items. Most likely this will bring the average cost higher. But it is still accurate. You have to figure out what you are going to do with the shipping costs that you have expensed prior to this (that is something to discuss with your financial advisor). However, it is still accurate…

Here’s another way to do the same thing:

1)Before receiving the PO, determine the shipping cost of the entire PO. Add up how many total inventory units are on the PO. Divide that number into the shipping cost-Example: Shipping cost $1000, # of units on the PO, 10,000=shipping cost per inventory unit=$.10/each.

Then create a new inventory part code for the $.10/shipping cost per unit. Put 10,000 units of this code on the PO.

Make a new inventory assembly code for the inventory item that includes the inventory part item code and the shipping cost item code. Receive the PO.

Now build the inventory assembly item, marrying the inventory part and the shipping cost. Your inventory assembly item now has the landed cost. If this inventory assembly item is part of other finished goods assemblies, you will have to put this new landed costed code into those.

This is what we have been doing, but it sounds like there ought to be an easier way!!!

I really like your advice, how would I handle an order using your suggestion if the order contains dozens of different items ranging in price from $8.00 to $95.10?

The vendor bases their shipping cost to me by the weight of the package itself.

Would I be better off as entering the shipping cost as en expense in this case?

Leslie, you need to talk to your financial/tax advisor. In general, the IRS (if you are US based) wants you to allocate the shipping cost to the items, not expense it. Sure, you can expense it easily, but that might not be what your tax person will recommend. Dividing it up manually by a near approximation should be fine.

You can also use a utility like the one reviewed in this article: http://www.sleeter.com/blog/2014/01/quickbooks-freight-allocator-utility/

Interesting, Mike, thanks for your comment. Sounds like a lot of work to do all the “builds”, and that doubles the number of items in your item list. ANd you have to make sure that you sell the assembly, not the “raw material” version of the same item.

Charlie,

You’re right, it IS lots of work, but it helps us properly allocate the freight costs over the time it takes to use or sell the inventory.

We actually don’t sell these components, only use them to manufacture the finished goods which are then sold. The raw material code should have a zero quantity once the build is done.

I’ve always wondered why the landed cost concept is so difficult for Quickbooks to handle. It would make sense to me if a freight cost factor could be included as part of setting up an inventory item. That’s how we used to do it when I worked for a large wholesale distributor.

I would like to thank you for your very thorough instructions.You have certainly cleared things up for me. I do have one question.. We have finished product at the one main warehouse. We have multiple warehouses across the country that store our product. How do I allocate product from the original warehouse to the other warehouses that store our finished goods.

Tina

Tina, that would depend on how you have your inventory set up, and how you are using QuickBooks. Also, are you using an add-on to manage warehouses?

If you have separate items in your item list for each SKU at a particular location, you would use inventory adjustments to move items about.

Thanks for all the information but I would like your advice on how to best handle shipping, brokerage and exchange rate issues for a very large number of items. We would like the cost of the inventory item to reflect the “landed cost” (which we can estimate)but shipping etc, which will be paid to other vendors won’t arrive until long after the thousands of items arrive. I am thinking the method Dick Kusleika suggested in his post on Mar 10/09 might work the best but since the freight, brokerage, etc don’t get paid to the same vendor we would have the issue of clearing out the accounts payable account. The method you have suggested works well if you only have a few items but for thousands of low cost items we do not want to have to do a cost adjustment on each one to allocate the actual extra costs. We would be OK using a cost which we should be able to estimate fairly accurately.

Cathy, I’m not sure I have a good answer for you. If you want to adjust the cost of individual items, you have to make adjustment transactions for the individual items. I don’t know of a “batch” way to do this easily for a large number of items.

Thanks for your quick response. I think we are resigned to having to use estimated costs for each individual inventory item. We would like to know if you have any suggestions for how to track and reconcile the various actual vendor invoices with what we are entering for our estimated inventory items.

Cathy

Hi.. How can i put the freight cost paid by our company in Quickbooks? If you could give me tutorials how to do it, that would be great. I am using 2009 version. Please help. Thanks.

Bebz, are you looking for something different than what is outlined in this article?

Hey Charlie, thanks a bunch for this info. After many hours of searching this is the only solid information I can find on landed costs in quickbooks.

Like several posters above, I have POs that have hundreds of items which totals thousands of dollars and maybe only 15-20 dollars in freight since the parts are very small. My supplier charges the fright to my UPS account who bills me separately, and I really don’t want to have to do an adjustment on hundreds of items each time I put in an order. Wouldn’t I be able to adjust the ‘current value’ of just a few high volume and commonly used components in my assemblies?

For example, I have some parts that I keep thousands in inventory, but also use hundreds a month in my assemblies. If I split that $15-$20 of value adjustment between just a couple of those parts, the cost per part will become nearly negligible.

You’ve stated many times you’re not an accountant, but do you have any thoughts on that approach? Thanks.

Dan, again, it is something to talk to your accountant about. The IRS wants the landed cost for inventory – I would think that if you put it somewhere as an asset (instead of expensing it directly) they might be happy with it, but I can’t really say. Your approach sounds reasonable to me, but I have no basis to judge it’s legality.

Hi Charlie,

So to enter the total shipping cost, I’ve created a dummy vendor called Freight Services and entered the whole amount there under shipping cost clearing account. Now after the adjustment, I should add freight & other costs to there respective vendors as well, right? Or will it double all the entries? If not, than how do I pay for this freight cost to the vendor?

Atif, I’m not sure whey you are creating a dummy vendor for this? If the freight comes from a particular vendor, use that vendor, then you can pay the bill…

Thank you so much for a great explanation.

Hi Charlie, Thanks for the information. In above case presume I have stock on hand 5 units and have purchased additional 100 units with shipping charges $40. Now while adjusting Inventory value I would like this shipping charge to impact only on the 100 units and not on 105 units (Total Stock on hand).Let me know is there any way we can do the same.

We are purchasing multiple items with freight and shipping paid to different vendor than supplier. I have already tried out “On the original invoice I gross up the item cost for shipping, then add a negative line (on the expenses tab) to back it back out” but this one leads to change in the purchase cost which will impact us in making future purchase orders with our suppliers.

Is there any way that we can include an addition column in the enter bills sections called overheads i.e QTY * Cost + Overheads = Net amount of the item so that the purchase cost and overheads get reflected separately

Mohammed: First of all, there is no way to edit the “enter bills” template in QuickBooks.

Second – keep in mind that QuickBooks is working on the basis of “average cost” for the financial issues. So you are just throwing all of the received costs into one big bucket of the total cost of all the items on hand. QB won’t let you keep one ‘lot’ of items at one cost, separate from any other ‘lot’ of the same item.

Thanks Charlie, is there any way we can maintain Multi warehouse option in Quick Books.

Mohammed, with the US Enterprise 11 product there is a multiple warehouse option available for an extra fee. See https://qbblog.ccrsoftware.info/2010/09/quickbooks-2011-advanced-inventory/

Other than that, you would have to use a third party add-on product.

In the above example 10 units are record at the cost of 11$ per unit.

When further unit of such items is purchased and if we followed the same procedure than shipping charges will be allocated to all unit in hand(New Purchase + Stock) of such items, but shipping charges are solely pertained to new purchase units.

Kindly comment on the above said issue.

Rameez – QuickBooks doesn’t do “specific costing”. It does average costing, so that when you receive an item at a particular cost, that value is averaged in with the existing cost of all quantities of that item. If you then sell an item, the COGS value is the average cost, not the cost at which you purchased the item. So, the fact that shipping charges are brought in to the overall item cost is congruent with how the item costs are handled.

Hi, we are deploying Quickbooks 2012 Premier enterprise manufacturing edition. Here to fore we prorated our shipping costs as a percentage of each items percentage cost of the total order. In other words if the value of a particular item was 5% of the total value of the pallet it was assigned 5% of the freight bill. Sor far I have not been able to find a way to do this in Quickbooks. Am I chasing a ghost?

Tom, you can do it manually with adjustments, but there isn’t an automated way of doing that.

Hi, thanks so much for the response. Manual adjustments times hundreds of items per pallet sound tedious at best. Can the information be imported via something like a spread sheet?

Other than what I laid out above, there aren’t any really good options for handling this. Your alternates are to not include shipping in the landed cost, or you can try doing adjustments through an import but that is going to be complicated. You can import transactions into QuickBooks using the IIF transaction import method, but that is risky because IIF does very little error checking. And it is complicated to set up unless you use a tool to help you. A better import method is to purchase the Transaction Pro Importer and use that (see https://qbblog.ccrsoftware.info/2010/01/importing-quickbooks-transactions-with-transaction-pro-importer/). Still takes a bit of work to set up.

Again thank you for your replies. It would seem that establishing cost control protocols that are based on landed costs per item is important enough that doing the mental math to prorate the shipping per item externally and than inputting it when you accept the inventory with a bill/PO is the simplest route. Will I have the same difficulty establishing a percentage discount based on weight?

Tom – yes. “weight” isn’t a field in the QB database. You can use a “custom field” for that, but you can’t do calculations based on custom fields.

Hi,

Using your example of purchasing all like items it seems quite easy to assign a value to each item by simply dividing the shipping evenly between each like item but when the items are all different how do you assign a landed cost to each? Would you simply divide the shipping by the total # of item’s purchased or by some other means.

As an example, say I have an invoice that looks something like this:

Item A 50 @.36 = 18.00

Item B 5 @8.75 = 43.75

Item C 10 @2.10 = 21.00

Item D 2 @14.90 = 29.80

Item F 4 @.52 = 2.08

Item G 3 @38.32 = 114.96

Total = 229.59

Shipping cost = 22.50

In this example there are a total of 74 items that were purchased. Each item has a different cost and weight, etc. How would you go about assigning a landed value to these items?

Thanks in advance for your help.

Amber, apologies for not getting back to you sooner. I was out of the country for a week – and our SPAM filter set your comment aside because of all the @ signs, it was taking them as email addresses. I edited some spaces in there to get it to appear.

How you do this is up to you aren your accounting advisor. I don’t know what the official answer is, from a tax standpoint (as I understand it, the IRS wants the landed cost, but I don’t know if they specify how you do that).

From a practical standpoint, not as a CPA or tax advisor, I would think that you could just divide the amount up equally if that saves you a lot of time. The more detailed you are with proportionally dividing it the more accurate your valuations are, but that could take a lot of work. It depends on how accurate you want to be and how much time you can afford. But, check with your accounting advisor…

Hi Charlie,

Thanks for responding to my first question.

I have another question about figuring landed cost when there is a discount applied to the invoice.

I am new to Quickbooks and just read that when you use the pay bills feature that it allows you to take a discount if offered by the vendor. It was mentioned however that the amount recorded in the accounts payable register is for the amount of the bill and the discount gets assigned to whichever account you specify. My question is how do we assign a landed cost when there is a discount…say 2% 10 NET 30. Is the discount taken off each item so that the landed cost would include this discount or is the discount taken as say income in another account, or…??

Your insight into the matter is appreciated.

Amber

Wow, Amber, that one is above my pay grade. I’m not an accountant. Personally, I wouldn’t worry about working the discount amount into the landed cost unless it is a significant amount. But, that is just me on the practical side, I’m not sure what the best answer is from a tax or proper accounting standpoint would be. Sorry!

Charlie and Amber,

I am an accountant in a food import/export trading company in the US. We use landed cost in all of our transactions. The methodology we use is to allocate all additional freight and handling costs to the inventory items based on weight, or by case count, depending on the mix of products you are shipping/receiving. Weight and cube are the primary bases of determining freight rates (in addition to distance and speed) so these should be the primary factor to consider in costing our inventory. For example, A box of screws is rather small and light compared to a case of hammers. It doesn’t make sense to add the same amount of freight costs to the screws as you do the hammers. Multiply this across an entire freight container/trailer and you get my point.

Also, for those involved in international import/export trade, there can be MANY different charges and vendors involved in these transactions (truck, rail, steamship, port charges, warehouse/cross dock, inspections, documentation, etc.). It is definitely NOT for the faint at heart!

Hope this helps.

Pat

Amber,

In answer to your specific question about the discount, we DO include it as a net credit to our landed cost of product. That is not really a tax question so much as an internal accounting / management reporting issue. (Tax is based on the net so whether you apply the credit to the COGS [cost of goods sold] from inventory or as a direct credit to expense, the net is the same.)

Pat

Hi Charlie,

I know this is an old topic but I’m hoping you’re still monitoring it. I’m blown away by the fact that after buying QB Pro and then QB Premier, I still have to jump though all those hoops to properly allocate “other” inventory-related costs to my items, such as freight, duty, etc. If I just put freight as an expense then I don’t have very good insight into the ACTUAL cost of my products for pricing purposes, but if I just roll the additional costs into the item cost without breaking it out, I have no idea what portion of my cost is freight, etc – that I might be able to negotiate, etc.

What really surprises me, after reading your blog and your comments (and Rustler’s comments) on the Intuit community, is that neither of you mentioned that Intuit DOES know how to do this – it’s part of QuickBooks POS. Check out the following help file:

http://support.quickbooks.intuit.com/support/pages/inproducthelp/POS/POSv6_Basic/qbpos_receiving/voucher_spreadcosts.htm

Of course, POS doesn’t do half of the other things I need done (like assemblies, etc) AND it costs $1500!!!

I can’t really describe how angry I am right now after realizing that the most used small business accounting software is not at all what it’s cracked up to be and doesn’t provide some of the most basic functions one would expect from an accounting package.

Buck, both Rustler and I can list many, many things that we call “head scratchers” that Intuit doesn’t do in QuickBooks. Actually, Rustler may use a different term to describe it but I won’t print that.

POS is a very different product, written (originally) by different people, and it does things very differently.

There is no reason why Intuit can’t deal with this better other than they haven’t taken the time, they think other things are more important, and (in my opinion) they tend to not do things that don’t improve the revenue that they might generate.

Best I can say is to leave them comments in the “feedback” portion of the Help Menu – if enough people complain, they may pay attention. I know of a number of improvements that have been based on that kind of feedback.

In most of my cases, I pay my vendor for shipping, not a 3rd party freight company. But it seems like I can still use this method to allocate the freight cost to the average cost of the inventory items. Am I mistaken?

At the end you suggest using a QuickReport to check the net balance of the clearing account is zero. That worked great. But do you have a suggestion for how I can see what I’m spending on incoming freight in my situation? It think it would be a valuable number to know.

Thanks

Jennie, it is difficult to have a process that may cover all of the bases.

It would depend on how you get the bills and how you want things to show up on the billing side. Using my clearing account example, the “3rd party freight company” could still be the same vendor that you purchase the items from. So you could run this through a clearing account, but just enter two bills for the same vendor (one for the items, one for the freight).

I tested your (Charlie) method above for an order where the item Vendor charges the Freight-In to me directly on the same invoice and it seemed to work great. I’m using Pro2011.

On a Bill, I entered the item quantities and cost on the Item tab and I entered the freight-in charge on the Expense tab, allocating it to the Shipping Cost Clearing Account.

Then I did the item value adjustment, following your procedure in detail, and it worked just fine. Am I missing something?

I know you suggested only using this method if the freight was charged separately but I don’t see why. In my case, we have some vendors who charge us the freight-in cost and other vendors we have to use a freight company (different ones – not just one) to pick up from and so we are billed separately for freight-in on those orders.

One other question I have is regarding tracking the Freight-In. By using the clearing account, which always should sum to zero, it seems that I can’t get any type of report that tells me what I spent on freight-in. (This is important to me for future cost cutting.) I can do a report on the clearing account and see all the transactions that are in there, and then manually with a calculator, I can add all the numbers from one side of the transaction, but that is pretty ridiculous to have to do.

So I was thinking that if I create a Class called “freight in” and use the class when I enter the Freight-In on the incoming Bill, but DON’T use it when I do the adjustment, then from an accounting standpoint (debits and credits to/from expense accounts, etc) it doesn’t make any difference, but from a reporting standpoint, I’ll have a way to at least view the total $ paid on Freight-In. Does that sound kosher to you? Again, am I missing something? (I’m not an accountant and I’m a QB newbie so I could definitely be overlooking something here.)

Thanks for your input.

Buck, you can mix the methods if you wish, using the expense holding account even if the bill comes with the receipt. It is just that this is a lot of extra work to do the adjusting/clearing transactions.

The advantage of that is that you do have a separate transaction/account for the freight posting. I would look into creating a “Custom Transaction Detail Report” that was set to filter the freight expense account, to see the information that you want.

Hi Charlie,

Re:”Buck, you can mix the methods if you wish, using the expense holding account even if the bill comes with the receipt. It is just that this is a lot of extra work to do the adjusting/clearing transactions. ”

But isn’t using the value adjustment the only way to 1)properly account for the landed cost of the item while maintaining the “cost” of the item at its real cost; 2)properly allocate freight cost to items so that the average cost reflects what you’re really paying (including the freight); 3)even remotely giving your self a chance in heck of figuring out what you’re paying in freight for particular items.

Otherwise, wouldn’t you be changing the “COST” of the item at each order AND you’d have no way to (even manually by looking at reports and adding up on paper) see what you paid in freight for those items?

I hope I’m not being to nit-picky. We’re trying to get QB implemented and all these details of where QB doesn’t do simple functions that any rational person would expect is really holding us up – we don’t want to start down the wrong path and have to start over or redo a bunch of work.

Thanks

I guess I didn’t make things clear in my short explanation.

You can use the expense tab on the original bill, at the time of the receipt.

You can use the inventory clearing account, and then make the adjustment to revalue the item to include that amount.

You can play with a Custom Transaction Detail report to filter for the expense adjustments, to see the values of the freight that you’ve paid. These are powerful and flexible reports that people often aren’t familiar with, and they can help a lot.

It isn’t simple. QuickBooks doesn’t manage this well as I think we can all agree. The best solution depends on many factors, such as your view of what your “cost” should include from a financial and tax viewpoint, how you want to manage costs from a managerial standpoint, how you want to track freight costs from a managerial standpoint, how long your items remain in stock, and more.

There isn’t one solution for everyone, and it is hard to lay out all of the options for a particular business without doing a careful analysis of your individual needs. Unfortunately, we often find in QuickBooks that we have to compromise, or find a workaround.

There is a 3rd party application called VISCO that integrates with QuickBooks that is designed to improve on QuickBooks landed costs function. Full disclosure…I work for this company.

Thanks for pointing that out, Tim. I hadn’t seen your product before. For my readers, Visco takes inventory entirely out of QuickBooks and uses QB just for the accounting back end. This is one of the more expensive add-on products (like Fishbowl Inventory, for example), and by keeping inventory out of QB you get away from many of the limitations. VISCO is a Gold level certified product, which is good. However, I do have some concerns about the integration. This appears (from a VERY brief look I’ve had) that there are a number of shortcomings in the integration, which are the typical ones we find in these kinds of packages. I particularly don’t like how they post sales tax – it either isn’t posted or (more likely) is lumped in with sales.

Thanks Charles. We do post sales tax as misc. charges. These are mapped to other GL (admin can do the mapping). Product sales are mapped to the Sales account.

Charlie,

All of our inventory has been input as non inventory items. I’m not sure if that’s what we should be using. We manufacture decals and buy vinyl, ink and adhesive to make the decals. Most of our decals are printed as they are ordered. We do not stock our decals. Can you tell me which inventory item I should be using? Thanks so much.

Mallory, you posted the same question in the QuickBooks and Beyond blog, here’s my answer copied from there:

How to handle this depends on the version of QuickBooks you have, the kind of analysis you want out of QuickBooks, how much time you have for data management, how long your vinyl and ink supplies stay around, and some details about the decals that you are printing. Lots of issues involved, so it is hard to give a short answer in a blog comment.

For example, if you have QB Pro, you don’t have assembly items, so that limits your choices.

If your decals are “stock” items, that you repeat, you might make them inventory assembly items so that you can consume the vinyl and ink and get some cost analysis of your produced items. But that makes more work, you have to “build” the decals, which takes extra steps.

If your decals are custom made each time, with different amounts of ink/vinyl, then assemblies might not work (although if you have QB Enterprise then there are ways to make that work). You might consider using a generic Group item that you modify each time you issue an invoice. But you don’t get the cost-to-make analysis.

If your vinyl and ink are bought in large bulk quantities, and are low cost per unit, and are used up fast, those might be non-inventory items. But that changes how you do the accounting…

[…] landed cost of the item. There are several ways of handling that in QuickBooks (see my article on shipping costs and QuickBooks inventory), although I wish that QuickBooks handled it more […]

Awesome! This article was just the ticket I needed for import items and figuring freight into item costs as the freight invoice comes separate from another company.

Thank you!

Hey All,

How are you ?

Well Ive just started to mess around on Quick books and after reading this I think im more confused than I was before lol.

Anyway I import toys into South africa and have an 2nd party Freight Agent who gives me the bill before it lands.

So what I have been doing is taking the cost of the Item and adding a % for shipping per Item of lets say 50% cause we get ripped of here but besides the point.

Each toy has a different Value, weight and size so the bigger it it is the higher that’s why Ive worked out on a % basis.

Hopefully this is correct ?

As for Entering all this into Quick books. should I enter the totals of the PO from the Vendor and then add a bill for the freighting

Or

Add the shipping bill to the PO ?

Ryan, this article pretty much spells out what you ned to do. You have to manually enter the value. There isn’t a formula, or automated way to do it in QuickBooks.

Thanks Charlie for that excellent tutorial.

I just wanted to comment that our situation is further complicated by the fact that we do not receive our shipping bills for as much as 60-90 days after the product has shipped. During this time period we could have received and sold the product before even getting a chance to do the value adjustment.

In our case we must estimate all our other landed cost when we physically receive the product (i.e. create proforma bills). While we have a pretty good idea of what these costs will be in advance, it still creates a small problem of having to periodically adjust the suspense account for differences.

I would also point out that normally bills get entered when the debt is incurred (i.e. the bill date) – in our case that would be the date the product shipped (FOB China) which is about 20 days before we actually receive it. The time spent on the ocean is kind of like having another warehouse that we cant get to 🙂

I am not sure of what the accounting rules are but… if we were to enter the bills on their ship date, but not adjust inventory value until 20 days later it would create a situation where we have payables on our books but have not registered the asset value yet.

I am sure the 20 day delay could be handled with more suspense accounts but for me its simpler to consider the bill date as the date it was physically received at our warehouse – which is also the date the value adjustment would be performed.

Your thoughts?

Bill, when you get into the kinds of situations that you are talking about, with importing and the bill coming in so far away from the receipt, I would defer to what the accountants tell you to do. Not being an accountant, I don’t want to give detailed advice here.

Off the top of my head it looks to me like this is a situation where you track the shipping costs separately and make an adjustment to your inventory valuation at year end for tax reporting purposes, but I can’t say if that is right or not.

This is great, but what if you already have quantity on hand? Lets say I already had 5 sprokets left at a landing cost of 9.00 and now shipping has increased and my new order of 10 for a landing cost off 11.00 a piece has arrived-how do I do this? Each time I try to adjust the cost it changes the cost for ALL sprokets in stock!

thank you!!

QuickBooks is an “average cost” system, so any time you do a receipt of a new item you are adjusting the average cost, which affects all items. That is the way that it works.

Hi Charles,

I’m not an accountant, but had an idea about handling inbound shipping on inventory and hoped you could comments,…

This is a real issue in the company I run, which imports refrigerators.

First, I create an inventory part called “inbound shipping”. Every time I get a shipping bill for inventory items I buy imaginary “inbound shipping items.” If I get a $10,000 shipping bill (2 containers from Europe), I buy qty = 10,000 of Inbound Shipping items which cost $1/item. Now I have 10,000 inbound shipping items in inventory! (no expense)

I have a reasonable idea about cost of shipping for each of the ~10 items I import. So I add “Inbound Shipping” to the BOM for my appliance assembly. In my case the cost ranges from about $40-$120 per item depending on size. So each assembly includes a quantity of Inbound Shipping which approximates the cost. A typically fridge might have 75 units of inbound shipping ($75).

However, over time I might run low on Inbound Shipping items if I’ve allocated too much in the BOM or I might accumulate Inbound Shipping if I allocated too little.

Does this seem like a reasonable method and can you suggest a process to periodically adjust the Inbound Shipping Item Quantity?

Thanks.

David, I wouldn’t use inventory part items for this. You don’t need to count the quantity (unless you really need to track how many you have “available”) and if you run out of them, you can’t build any assemblies. If you use them in other transactions and you get a negative quantity of them, that creates a mess.

You could try something similar using non-inventory parts. They can be used in a BOM as well, if that is your aim. You would have them posting to a holding account, and then the builds would pull from that holding account.

I can’t comment about how this works with IRS regulations – you are adding that burden to an assembly item, which might not be built until a later time, rather than to the received component item. You’d have to talk to a financial advisor about that.

Hello Charlie,

Great article. If we have noticed this way of adjusting value and want to make the change, how do we make the changes for past freight costs (several months or years ago)? This is because we have already submitted our state tax quarterly and if we make the adjustments in quickbooks, it will alter all the profit and loss data from past months. Please help!

Several months ago, that shouldn’t be a problem assuming it is the same tax year. For prior tax years, you should talk to your financial advisor. You can make adjustments to the average cost of items with a current date, which wouldn’t affect prior years, but there are some big tax implications here even so. That is why you have to talk to your financial advisor about your particular situation.

Hi Charlie, very good and clear explained article it is been very helpful.

I have a question, what happened if after I made the adjustment, the “Shipping Cost Clearing Expense” balance is not Cero (0)? i do not know what happened, maybe a typo while entering the adjustment. The balance is minimum (-0.02), is there a way to make a correction (edit the adjustment), or maybe i can make the correction in the next purchase adjustment considering that difference? or should i be concern about the this small discrepancy?

Another question (out of this topic), is there a wet to tell quickbooks that the sale prices already include the vat?

Hope you can help me, the most whit the first quietion

You could just do a journal entry. It could be a rounding error, or a typo. Just don’t do a journal entry to the “Inventory Asset” account, as that causes problems.

I can’t answer VAT questions as I don’t have access to a non-US version of QuickBooks, sorry.

hi, while adding items in vendor> Entering bill then clicking on items there were no heads then i clicked on new head there were options of services Non-inventory others but there was no Such Inventory option in it kindly tell how to make that one to open inventory items in vendor.

You need to enable the purchasing and inventory option in your preferences to be able to add “inventory part” items.

Dear Charlie

A quick question

I have imported goods let’s say sprockets 10 pcs @ 10 dollars

The customs charge me gst of eg 20% which is payable to customs and not the supplier . I would.like to enter the invoice through the receive goods and Bill option

My problem if I do factor the customs directly it will show I owe my supplier 20% more how do I correct this hope am clear as am typing on my fone and have not had a chance to review my post

You have to enter the bill separately, since they are payable to two separate vendors.

You can create a holding account for the customs charges, and then post an inventory valuation adjustment against that account to move the value from there into inventory assets, to reflect the true cost of the item.

Hi

i just want to ask you about the repetitive nature of this process

i mean lets assumed that we re-bought 15 units of same item with different shipping rate(20$) do i have to adjust the value of all my inventory the 25 units with shipping expense of 30$ and so on

if so is that mean that i should keep a record of shipping to every item i purchase

because i have a high inventory turn over in my company and variety of items almost impossible to recalculate the value of theme each time i bought a new invoice

thank you in advance

You have to ask your accountant/tax preparer about how this is to be handled in your particular location and business. The IRS generally states that shipping costs should be rolled into the landed cost of the item. So that would say that every time you have a receipt you should do an adjustment. However, for many businesses, that isn’t practical. How to deal with it is first an accounting/tax question (which I cannot answer for you). Whatever your tax accountant recommends, that is what you do.

appreciate ,best regards

I am new to quickbooks so I hope my question is simple.

How would you use a vendor like Amazon to maintain and ship their inventory would account for inventory in QuickBooks.

Not a simple thing. To integrate Amazon with QuickBooks desktop you need an add-on product that would handle that. Could be expensive. Unfortunately, I don’t work with that environment so I don’t have a specific recommendation. That is a highly specialized field.